As technology continues to advance at a rapid pace, the world of banking is undergoing a transformative shift towards automation. With each passing day, financial institutions are embracing automation in order to provide customers with a seamless and efficient banking experience. Gone are the days of long queues and endless paperwork; banking automation is revolutionizing the way we manage our finances.

One key aspect of banking automation is the introduction of self-service solutions. From ATMs to mobile banking apps, customers now have greater control over their transactions and can access their accounts 24/7. This shift towards self-service not only provides convenience, but also enhances security and reduces the need for in-person interactions. As a result, customers can now perform a wide range of banking tasks from the comfort of their homes or on the go, eliminating the hassle of visiting physical branches.

Benefits of Banking Automation

Modern banking has become increasingly reliant on automation to streamline processes and deliver a seamless financial experience. The advent of banking automation solutions has brought about numerous benefits for both customers and financial institutions.

Firstly, one of the key advantages of banking automation is enhanced efficiency. By automating routine tasks such as transaction processing, account updates, and customer inquiries, banks can significantly reduce manual errors and processing time. This not only improves operational efficiency but also allows employees to focus on more complex and value-added activities.

Secondly, banking automation fosters greater convenience for customers. With automated processes, customers can perform various transactions anytime, anywhere, using digital channels such as online banking or mobile apps. This eliminates the need to visit physical branches, saving time and effort. Additionally, automation enables faster and real-time access to financial information, empowering customers with a personalized and self-service banking experience.

Lastly, automation in banking contributes to enhanced security and risk management. By implementing robust automated systems, banks can better safeguard customer data and transactions. Automation enables the use of advanced security measures, such as multi-factor authentication and real-time fraud monitoring, to ensure the protection of both customers’ funds and their personal information. Furthermore, automation enables banks to proactively identify and respond to potential risks, reducing the likelihood of fraudulent activities and financial losses.

In conclusion, banking automation brings forth a multitude of benefits, including improved efficiency, increased customer convenience, and enhanced security. As banks continue to embrace automation, the future of banking holds the promise of a more seamless and digitally-driven financial experience for all stakeholders involved.

Key Features of Banking Automation Solutions

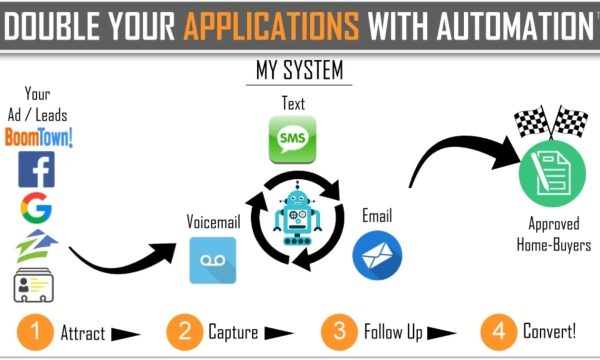

Banking automation solutions offer a wide range of features that streamline traditional banking processes and provide customers with a seamless financial experience. These features include:

Automated Account Management: With banking automation solutions, customers can easily manage their accounts without the need for manual intervention. They can open new accounts, update personal information, and perform various transactions such as deposits, withdrawals, and transfers, all through automated systems. This eliminates the need for paper-based processes and reduces the time and effort required for account management.

Digital Payments and Transfers: Traditional methods of payment and transferring funds are being rapidly replaced by digital alternatives. Banking automation solutions enable customers to make and receive payments electronically through various channels, including online banking platforms and mobile applications. These solutions not only offer convenience and speed but also enhance security and reduce the risk of human error in transaction processing.

Intelligent Customer Service: Automation in banking extends beyond transactional processes, as it also plays a significant role in customer service. Banking automation solutions incorporate intelligent chatbots and virtual assistants that can provide instant assistance to customers. These AI-powered systems are designed to understand and respond to customer queries and provide relevant information, making it easier for customers to find solutions to their banking-related concerns.

By incorporating these key features, banking automation solutions are revolutionizing the way financial institutions operate and interact with their customers. The future of banking lies in embracing these automation solutions for a seamless and efficient financial experience.

Challenges and Considerations for Implementing Banking Automation

Software To Create Forms

Implementing banking automation solutions can bring numerous benefits to financial institutions, but it also comes with its fair share of challenges and considerations. Here, we will explore some of the key factors organizations should keep in mind when embracing automation in the banking industry.

Security and Data Privacy: One of the foremost concerns when implementing banking automation is ensuring the security and protection of customer data. With the increasing number of cyber threats and data breaches, it is crucial to have robust security measures in place. Financial institutions must invest in state-of-the-art encryption techniques and multi-factor authentication to safeguard sensitive information and maintain customer trust.

Customer Experience and Engagement: While automation can significantly streamline banking processes, it’s essential to strike the right balance between automation and human interaction. Many customers still value the personalized service provided by bank tellers or customer service representatives. Financial institutions need to find ways to integrate automation seamlessly without compromising the human touch that customers desire.

Employee Training and Adaptation: Implementing banking automation requires employees to adapt to new technologies and processes. It is crucial for organizations to provide sufficient training programs and resources to ensure a smooth transition. Employees must understand the benefits of automation and how it can boost their efficiency rather than fearing it as a threat to their job security.

By addressing these challenges and considering the implications of automation implementation, financial institutions can successfully navigate the path towards a more seamless and efficient future of banking. Embracing automation while prioritizing security, customer experience, and employee adaptation is key to achieving long-term success in the rapidly evolving landscape of financial services.