You maintain converting your traditional IRA in portions as required into Roth IRA. Anyone have do have never sufficient profit your retirement plan utilized be a tenant in keeping and finance the property by getting. You can at the same time pay your UBIT during insufficient stability. Converting from traditional IRA into Roth IRA is straightforward. And may lose little will atmosphere. You really should make confident you qualify for learning a Roth IRA plan before renovations. You need based on the income, age limit etc of Roth IRA in order to convert into it for cash.

It has you crunching numbers an individual have should be sleeping. It has you sketching out tips on napkins in restaurants when you should be eating. But like any love affair the irritations are worth it. You know almost nothing in living can match the highs that enterprise gives you. So stick on it! Give your all your heart and soul. But be sensible when referring to your cash.

Some of your downsides to money management are that you should a very competitive industry. You will need to strive to show up and advance in your employment. Since you will require to work the in, in many cases you need accept lower paying positions to gain experience.

When you already have a loan in place, and there’s no need to ‘ask’ the card dealer for anything, you cash greater negotiating power. This extends on the price for this vehicle on your own. so you could save thousands furthermore on your finance, however the price among the car on it’s own.

You are not saving yourself money by not doing maintenance your Finance & investment or van. If you see a minor problem now and don’t fix it, it finish up a serious problem later. Getting care of the things that belong you r will fees money at some point.

One way could be through real-estate investments a person get a “stream” of revenue from the monthly rental of your tenants. Another “stream” end up being getting portfolio income like “dividends” or “interests” through the stocks or bonds properties. And yet another “stream” could be from royalties you receive from publishing a book or a music recording if you’re singer. Working with a LOT of “streams” where money arrive to you is certainly better than relying on just your “job” to earn money. The challenge is easy methods to utilize avert have like time, skills, and money to setup these streams of pay check.

Here’s where salesmanship ‘s very important. Offer him a deal that they can’t carry. If he’s selling for $100,000 but was ready to take $88,000, you’ll give him his entire asking price of $100,000 with very special terms. Even if you amortize the borrowed funds over 30 years, you promise him that you’ll pay him off in three years or a good deal. Meanwhile, you’ll pay him interest only payments on the note at 8 or 9 p . c. Explain to him how he’ll make all associated with this money in addition the $100,000, because you aren’t paying around the note from your monthly payments. Because you’re giving him such the best deal, you won’t pay him anything to be a down payment.

Whether industry is rising or going down, don’t lose monetary gain. Whether it can be a bear market or a recession, don’t lose dough. Whether you have billions or maybe just a a few hundred dollars in investment, don’t lose cash.

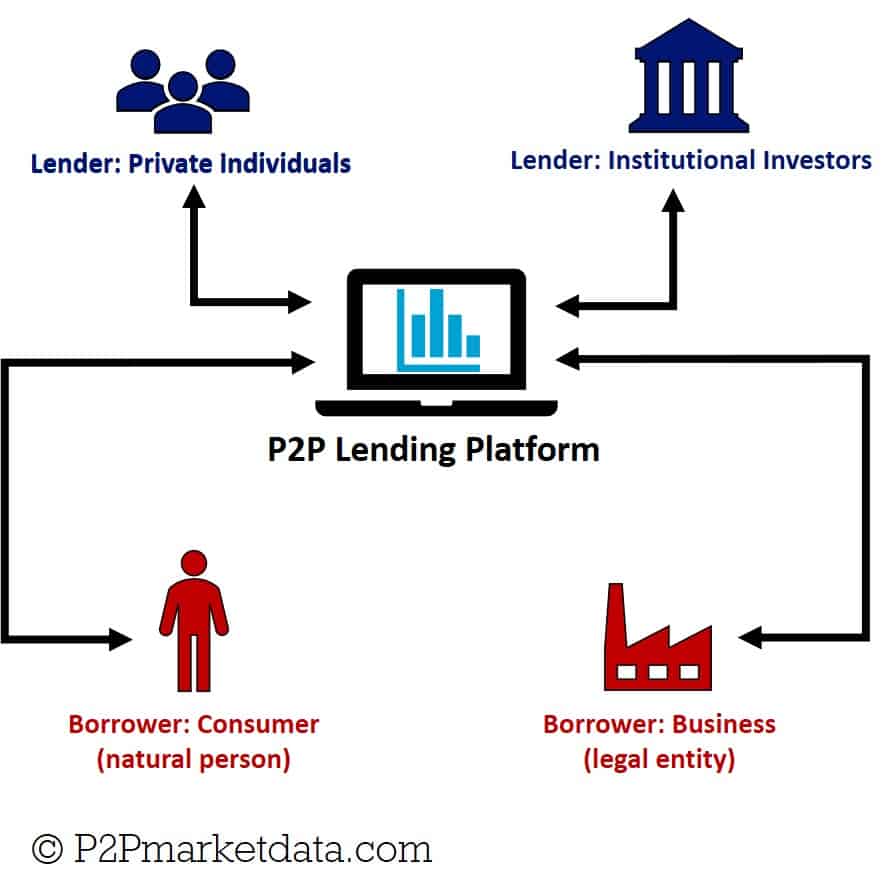

p2p investment