Insurance is like a safety net, a shield that offers protection and peace of mind in the face of uncertainties. It serves as a crucial tool for individuals and businesses alike, providing a sense of security and stability in an ever-changing world. One company that excels in offering comprehensive insurance solutions is Braly Insurance Group.

Braly Insurance Group stands out for its dedication to understanding the unique needs of each client and providing tailored coverage options that fit perfectly. With a strong focus on personalized service and expert guidance, they go above and beyond to ensure that clients have the best protection for their assets. By partnering with Braly Insurance Group, individuals and businesses can find reassurance in knowing that their insurance needs are in capable hands, allowing them to focus on what matters most while enjoying true peace of mind.

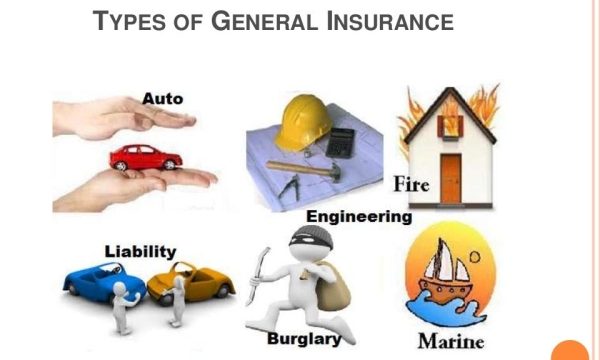

Types of Insurance Offered

When it comes to safeguarding your valuable possessions and securing your financial well-being, Braly Insurance Group offers a range of insurance options tailored to meet your specific needs. Whether you are an individual seeking coverage for your home, car, or other personal belongings, or a business owner looking to protect your company assets, Braly Insurance Group has you covered.

One key type of insurance they provide is property insurance, which includes coverage for homes, rental properties, and other real estate assets. This ensures that in the event of damage or loss due to fire, theft, or other unforeseen circumstances, you can receive compensation to repair or replace your property.

Moreover, Braly Insurance Group offers various types of liability insurance to protect you from legal claims and financial losses resulting from accidents or injuries that occur on your property or as a result of your business operations. By having the right liability coverage in place, you can mitigate the risks associated with potential lawsuits and ensure your peace of mind.

Benefits of Choosing Braly Insurance Group

When it comes to safeguarding your assets and achieving peace of mind, selecting the right insurance provider is crucial. Braly Insurance Group stands out for their commitment to tailored solutions that cater to both individual and business needs. Their dedication to understanding the unique requirements of each client ensures that you receive personalized service that truly addresses your concerns.

One key benefit of choosing Braly Insurance Group is their expertise in offering comprehensive coverage options. Whether you are looking to protect your home, vehicle, or business, they have a range of insurance solutions to meet your specific needs. By partnering with Braly Insurance Group, you can rest assured that your assets are shielded against unforeseen risks, allowing you to focus on what truly matters to you.

General Liability Insurance

Moreover, the emphasis on expert guidance sets Braly Insurance Group apart from other providers. Their team of professionals is equipped to navigate the complexities of the insurance landscape and provide you with clear recommendations based on your unique circumstances. This level of support ensures that you are equipped with the knowledge necessary to make informed decisions about your coverage, giving you confidence in the protection of your assets.

Client Satisfaction and Reviews

Clients of Braly Insurance Group rave about their exceptional service and dedication to finding the perfect insurance solutions for every need. The personal touch and care provided by the team make customers feel valued and understood.

Many satisfied clients highlight the prompt responses and thorough explanations offered by Braly Insurance Group, emphasizing how these qualities have made the insurance process smooth and stress-free. Customers appreciate feeling informed and empowered when making decisions about their coverage.

Positive reviews often mention the peace of mind that comes from knowing Braly Insurance Group has their best interests at heart. Clients trust the expertise and guidance provided, allowing them to feel confident in their insurance choices and secure in their protection.