In today’s fast-paced digital landscape, the way we work and do business has undergone a significant transformation. The emergence of digital services has revolutionized the […]

The Art of Winning: Mastering Bookie Management

Aspiring bookies and seasoned veterans alike understand the importance of efficient bookie management. With the right tools and strategies in place, one can navigate the […]

Mastering the Art of Bookie Management: Unleashing Your Betting Potential

Imagine you are stepping into the world of bookie management, where the thrilling realm of sports betting, casino games, and horse racing converge. With the […]

Crafting a Digital Presence: The Intersection of Web Design, Development, SEO, Marketing, and PR

Crafting a digital presence that resonates with your audience and drives results is a multifaceted endeavor that weaves together the art of web design and […]

Unlocking the Benefits: The Divorce Paralegal’s Guide to Smooth Separations

Divorce can be a daunting and emotionally challenging process, but with the assistance of a knowledgeable divorce paralegal, the road to separation can become much […]

Unveiling Opulence: Exploring the Realm of Luxury Travel

Welcome to the world of luxury travel, where opulence meets exploration on a grand scale. For those seeking the pinnacle of travel experiences, the realm […]

Unleashing the Beast: The Ultimate Guide to Bodybuilding

Welcome to the transformative world of bodybuilding, where strength, dedication, and passion merge to sculpt bodies into works of art. Bodybuilding is more than just […]

Unlocking Your Ultimate Physique: The Art of Bodybuilding

Welcome to the world of bodybuilding, where dedication, discipline, and determination converge to sculpt the ultimate physique. Whether you’re a seasoned gym enthusiast or just […]

Muscle Mastery: Unleashing the Power of Bodybuilding

In the Lone Star State of Texas, the spirit of bodybuilding and strength training burns brightly among dedicated enthusiasts known as the Texas bodybuilders. From […]

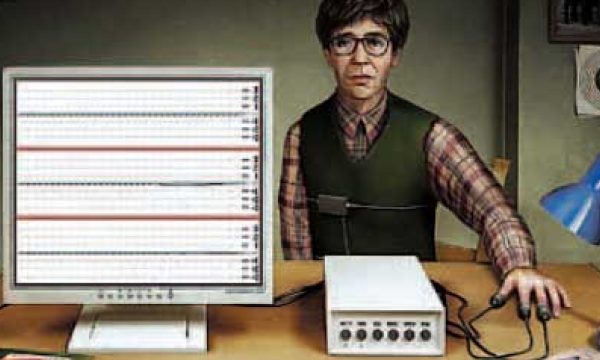

Unveiling the Truth: The Intriguing World of Lie Detector Tests

In today’s world, where the line between truth and deception can often blur, lie detector tests have emerged as a powerful tool for unraveling hidden […]