Building Financial Fortunes: Mastering the Art of Wealth Management

In today’s fast-paced and ever-changing economic landscape, personal financial planning has become more important than ever. Gone are the days when simply earning a decent income was enough to secure our financial future. Now, it takes a well-thought-out strategy and effective wealth management to build and protect our fortunes.

Wealth management, a term often associated with the affluent, is not exclusive to the wealthy alone. It encompasses a range of strategies and principles that can benefit individuals from all walks of life. At its core, wealth management is about making informed decisions that optimize financial outcomes and enable individuals to achieve their goals, both in the short and long term.

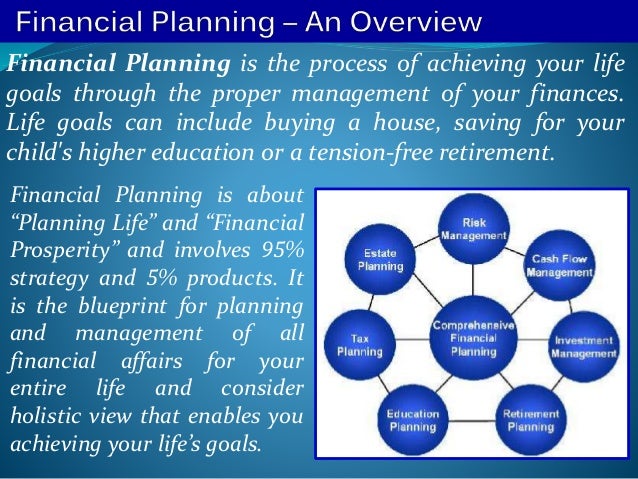

Personal financial planning is the foundation upon which successful wealth management is built. It involves assessing one’s current financial situation, setting realistic goals, and developing a roadmap to achieve them. This process requires a holistic approach, taking into account not only income and expenses but also debt management, tax planning, risk management, and investment strategies.

By mastering the art of wealth management, individuals can navigate the complex financial world with confidence. They can leverage their assets effectively, mitigate risks, and make sound investment decisions, ultimately paving the way for financial independence and long-term prosperity. In this article, we will delve deeper into the intricacies of wealth management, exploring key concepts and practical strategies that can help anyone take control of their financial destiny.

So, whether you’re just starting out on your financial journey or looking to take your wealth management skills to the next level, join us as we explore the art of building financial fortunes through the mastery of wealth management.

Setting Clear Financial Goals

Setting clear financial goals is a crucial step towards effective wealth management. Without well-defined goals, it becomes difficult to ascertain what financial success looks like and how to attain it. Personal financial planning and wealth management are closely linked, as both require a strong foundation of clear objectives.

The first aspect of setting clear financial goals is understanding your current financial situation. Start by evaluating your income, expenses, assets, and debts. This assessment will help you gauge where you stand financially and identify areas of improvement. It’s important to be realistic and honest with yourself during this process.

Once you have a clear understanding of your current financial situation, the next step is to establish short-term and long-term objectives. Short-term goals can include saving for emergencies, paying off high-interest debts, or investing in professional development. Long-term goals might involve purchasing a house, funding your children’s education, or retiring comfortably.

Your goals should be specific, measurable, achievable, relevant, and time-bound (SMART). This framework ensures that your goals are well-defined and actionable. For example, rather than setting a vague goal like "save money," a SMART goal would be "save $10,000 for a down payment on a house within the next two years."

In conclusion, setting clear financial goals is the first step towards effective wealth management. By understanding your current financial situation and establishing SMART objectives, you can pave the way for a solid financial future. Personal financial planning and wealth management go hand in hand, and by taking the time to set clear goals, you increase your chances of achieving financial success. Stay tuned for the next section, where we will explore the importance of creating a comprehensive financial plan.

Creating a Solid Wealth Management Plan

When it comes to building financial fortunes and mastering the art of wealth management, having a solid plan in place is crucial. A well-crafted wealth management plan allows individuals to gain control over their personal finances and take steps towards achieving their long-term financial goals.

Step 1: Assessing Your Current Financial Situation

The first step in creating a solid wealth management plan is to assess your current financial situation. This involves taking a closer look at your income, expenses, debts, and assets. By understanding where you stand financially, you can start making informed decisions and identifying areas that require attention.

Step 2: Setting Clear Financial Goals

Once you have a clear understanding of your current financial situation, the next step is to set clear financial goals. These goals will act as guiding principles and help you stay focused on what you want to achieve. Whether it’s saving for retirement, buying a house, paying off debts, or funding your children’s education, setting specific and achievable financial goals is essential.

Step 3: Implementing Strategies for Wealth Accumulation and Preservation

With your financial goals in place, it’s time to implement strategies for wealth accumulation and preservation. This involves creating a personalized investment plan that aligns with your risk tolerance, time horizon, and financial goals. Diversifying your investments, regularly reviewing your portfolio, and adjusting your strategies as needed are all integral parts of this step.

By following these three steps, you can create a solid wealth management plan that sets you on the path towards financial success. Remember, wealth management is an ongoing process that requires regular monitoring and adjustments. Stay focused on your goals, stay informed about the financial markets, and seek professional guidance if needed.

Implementing Effective Strategies for Long-Term Success

To ensure long-term success in personal financial planning and wealth management, it is crucial to implement effective strategies that align with your goals and aspirations. By following these strategies, you can navigate the complex world of finance with confidence and build a solid foundation for your financial future.

Define Your Goals: The first step in effective wealth management is to clearly define your goals. Take the time to reflect on what you want to achieve financially and create concrete objectives. Whether it’s saving for retirement, buying a house, or funding your children’s education, having a clear vision will guide your financial decisions.

Create a Diversified Portfolio: Diversification is key to managing risk and maximizing long-term returns. Spread your investments across different asset classes such as stocks, bonds, real estate, and commodities. This will help protect your wealth from market volatility and ensure you’re well-positioned to capitalize on opportunities.

Regularly Review and Rebalance: Financial markets are constantly changing, and so should your investment portfolio. Regularly review your investments to ensure they still align with your goals. Rebalance your portfolio periodically by selling investments that have performed well and reinvesting in those with potential for future growth. This disciplined approach will help you stay on track and adapt to market conditions.

Best Country For Black Expats

By implementing these strategies and making informed financial decisions, you can set yourself up for long-term success in personal financial planning and wealth management. Remember, wealth doesn’t grow overnight, but with perseverance and a smart approach, you can build a solid financial fortune that lasts a lifetime.